A new report from ABBYY indicates that financial services firms are adopting generative AI at a rapid pace while struggling to keep up with the governance challenges that accompany it. According to the State of Intelligent Automation: GenAI Confessions 2025 survey, 91 percent of financial services organizations now use GenAI, with most reporting measurable gains in accuracy, consistency, and cost savings.

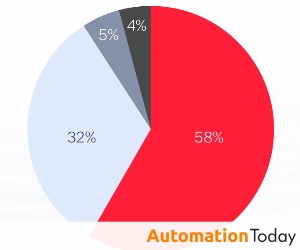

The findings point to a parallel trend: employee-driven experimentation. The intelligent automation technology provider says workers across banking and insurance are introducing generative tools on their own, a pattern the company calls “Shadow AI.” Survey results show that 22 percent of U.S. employees, 21 percent in Germany, and 26 percent in Singapore use AI without IT approval. In many cases, this bottom-up adoption prompted formal rollout, with 41 percent of organizations implementing GenAI only after staff had already begun using it informally.

“Businesses are spending money on GenAI tools that promise more than they can provide,” said Maxime Vermeir, senior director of AI Strategy at ABBYY. “In some cases, they don’t even need it. Before moving forward with GenAI tools for agentic automation, companies need to first evaluate their current processes and create a visibility map of their workflow with data analytics tools such as process intelligence.”

Regional data shows contrasting priorities—French firms plan increased budget allocations, U.S. organizations cite training complexity, and U.K. respondents report slower adoption due to stricter oversight. Across all markets, governance maturity lags implementation, with 26 percent of organizations lacking clear frameworks.

The report concludes that GenAI is becoming embedded in financial workflows, from fraud detection to customer engagement, but that institutions adopting AI successfully are pairing investment with guardrails, training, and responsible-use practices.